Banking solutions

With nearly 25 years of experience in the field of software, NazmAran Consulting Engineers has been active in the field of business intelligence and information analysis for more than 100 companies, organizations, ministries, banks and institutions for more than 15 years.

The result of this experience in the field of banking and financial institutions is the honor of performing various information analysis services and management dashboards in more than 10 banks and financial institutions.

Solutions

- Consulting and preparation of analytical reports and management dashboards

- Data mining and knowledge extraction

Consulting services and deployment of risk and sensitivity analysis systems (What-If) - Consulting services and preparing a strategic map of information use

- Consulting and setting up performance evaluation systems (based on the BSC model)

Technologies used

- Creating a data warehouse (Enterprise Data Warehouse)

- Establishing Business Intelligence

- Consulting and deployment of Big Data and Data mining solutions

Management dashboard and performance monitoring and improvement

- Preparation of various dashboards of financial functions such as cost and income and financial ratios

- Report on the composition of sources and uses and their changes

- Deviation from the plan and forecasts in deposits and credits

- Monitoring the performance of branches and offices according to the per capita indicators of deposit documents, facilities, and…

- The cost of money and its rates of change

- Evaluation of branch personnel and related analytical reports and human resource development

- Liquidity management dashboards

- Preparation of dashboards of competitive intelligence and recovery

Analytical reports

- Customer deposits

- Facilities and credits

- Analytical reports of PSP and ATM customers

- New cards and services

- Currency and Rial services

Analysis and data mining

- Analysis of facility and credit contracts using mathematical and statistical models

- Management and control models for risk assessment and risk management

- Fraud management and money laundering

- Analysis of arrears and claims

- Analyzing customer behavior and achieving customer relationship management goals

- Information analysis for the development of new banking electronic banking

- Sensitivity analysis or what-if analysis

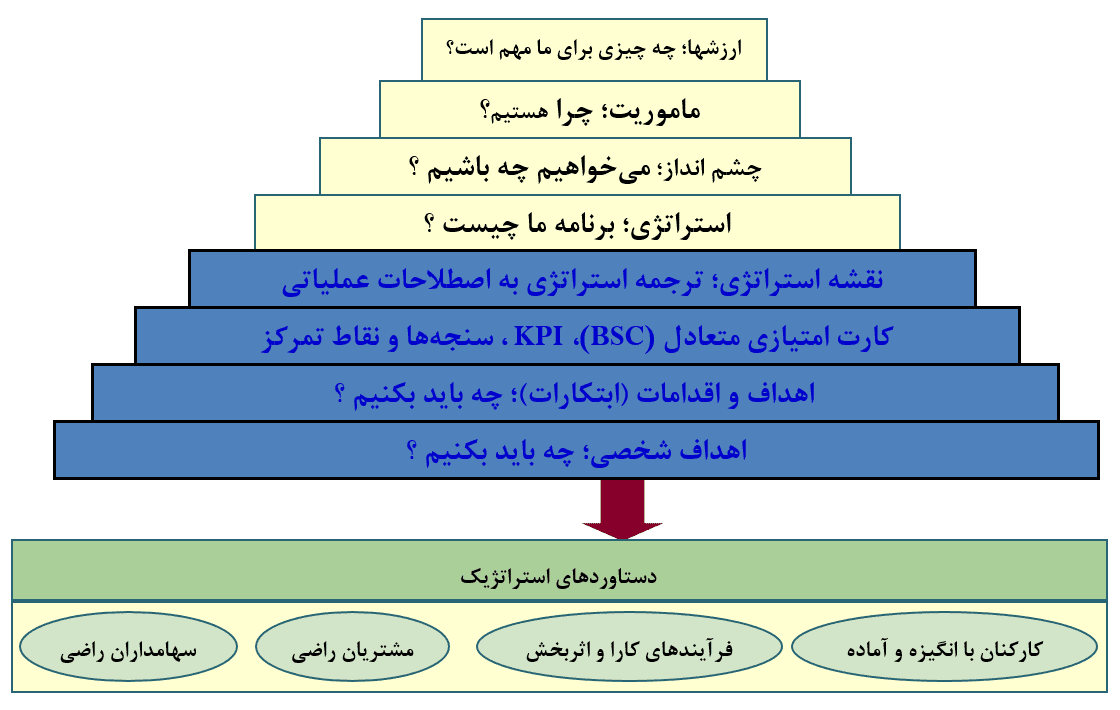

Preparation of a strategic map of the use of information in the bank

- Overview of the organization, goals, mission and strategies, plans and…

- Propose and provide solutions for data analysis.

- Identifying existing data subjects and analyzing the gap until the desired situation.

- Analysis of audiences and users and their subgroups.

- Content analysis, determination of information needs for decision-making, analytical data from experts and experts.

- Determining the content of reports and thematic division of content based on access.

- Definition of strategic, tactical, operational and practical management dashboards

Bank performance evaluation based on the BSC model

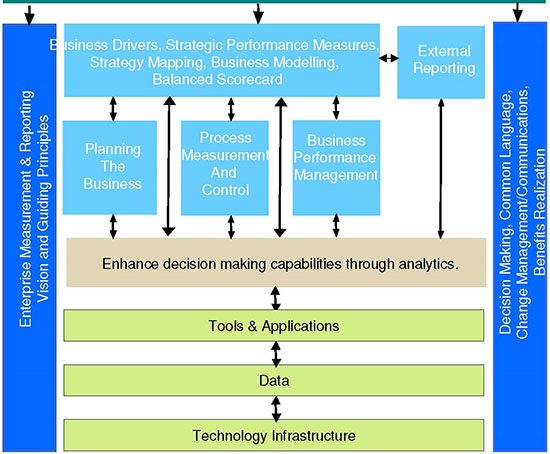

Business management in today’s world starts with strategy formulation and continues with planning and allocation of resources and budgeting and finally leads to reporting and performance monitoring and analysis.

One of the common ways to implement this cycle is to study, design and implement the balanced scorecard model.

This model starts from values and goals and proceeds to innovative actions using the strategy map.

Today, performance management based on the BSC model and its link with organization strategies is one of the main axes of management systems in organizations.

In this regard, the following actions are necessary to implement the developed strategy.

- Studying high-level documents of values, mission and organization and…

- Defining and following the principles of a strategy-oriented organization

- Preparation of a comprehensive road map with the lowest cost and maximum benefit produced

- Prioritizing new projects based on ROI, strategic value and ease of implementation

- Identification of existing data subjects, Data Subjects and gap analysis until the desired situation.

- Communicating values, goals and plans with innovative actions and analytical reports and dashboards

- Defining the needs of supervisory units and aligning them with the goals.

- Unification of definitions and identification of performance indicators and KPI

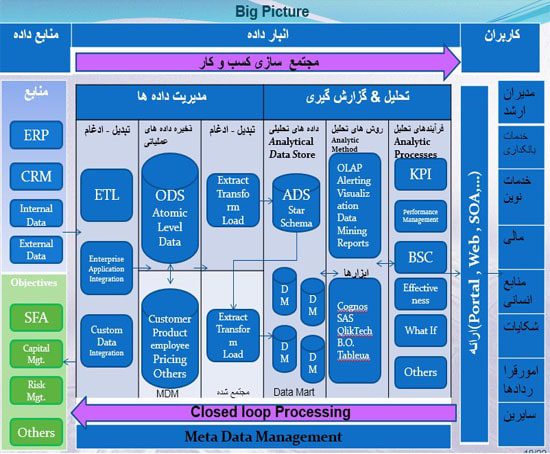

Creating a data warehouse and deploying business intelligence

Considering the volume and variety of information in banks and financial institutions, one of the steps that can be taken is to create a comprehensive data warehouse.

In such a way that the information required for analysis and decision-making can be cleaned and aggregated from various information sources, and the appropriate output can be presented to different users in the process of analysis.

Finally, after creating a comprehensive data warehouse, the business intelligence layer and appropriate analytical tools are deployed on it.

Actions can be taken as follows:

- Data warehouse design based on required processes

- Selection and combination of technical tools and methods for data warehouse and business intelligence.

- Converting and transferring and uploading information from existing information systems to the data warehouse.

- Creating management dashboards and various analyzes and implementing strategic indicators.

- Compilation of measurement indicators and KPIs / information analysis and analytical scenarios.

Consulting and deployment of Big Data solutions

Due to the large amount of information available in banks and the high growth rate and variety of information, today for some needs such as quick search of all bank information or comprehensive analysis such as customer behavior analysis, big data technology can be used.